We let you bank your way

While many of our customers find it more convenient to do their banking online and on our app, we recognise that sometimes nothing beats the reassurance and safety of face-to-face banking.

We believe that you should be able to bank exactly how you want. On our app, online, on the phone and on the high street, as you like.

We're committed to keeping our branches

We have committed to keeping every one of our branches open until at least the start of 2030*. You can check when your local branch is open using our branch finder.

*Our branches’ opening hours may vary. Circumstances outside of our control may mean we have to close a branch if there's no other workable option.

Our call centres are all based in the UK

We believe you are best served by people living and working right here in your communities. And also at times to suit you. Our call centres are open:

- 8am to 8pm Monday to Saturday and bank holidays.

- 9am to 5pm Sundays.

You can ‘chat’ to one of our advisers 24/7

Chat to one of our advisers 24/7 with webchat.

If you need to speak to someone about your banking, you can get through to a real person, 24 hours a day, 7 days a week using the chat service we provide in our app or internet bank.

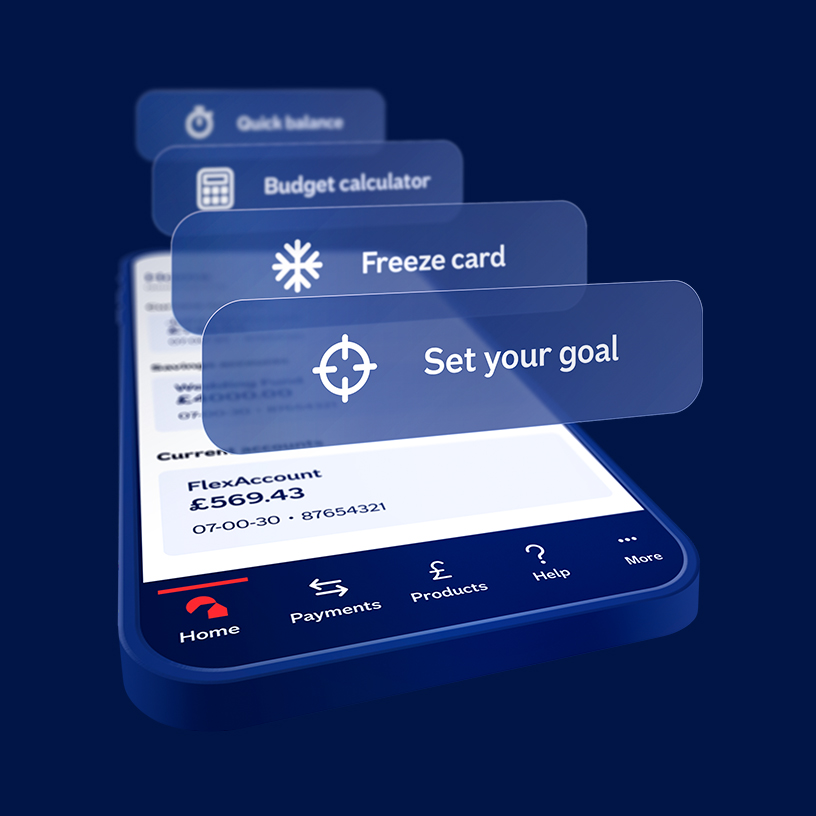

The Nationwide app. Safe, secure everyday banking made easier.

A good way to bank? Our customers think so. We’re rated 4.8 stars in the App Store and Google Play (mobile only) as of 2 March 2026.

Browse our current accounts and become a member

FlexAccount

Our everyday bank account.

- Apply for an arranged overdraft

- App, internet and telephone banking

- Contactless payments

No monthly fee

FlexDirect

Our online bank account with cashback and interest.

- Access to interest on balances up to £1,500*

- Access to 1% monthly cashback for the first 12 months*

- Apply for an arranged overdraft

- Contactless payments

*Conditions apply

No monthly fee

FlexPlus

Our packaged bank account.

- Worldwide family travel and mobile insurance

- UK and European breakdown cover

- No Nationwide fees for using your card abroad

- Apply for an arranged overdraft

- App, internet and telephone banking

- Contactless payments

£18 monthly fee